Ever see those inspirational posts about people achieving massive financial goals at a young age? This isn't about get-rich-quick schemes, but a practical guide to building a $400,000 net worth by 30. It requires dedication, but it's entirely achievable. We'll outline the steps, from budgeting to investing, showing how others have done it, using real-world examples to illustrate the path to financial independence.

Building Blocks of a $400k Net Worth: A Step-by-Step Guide

Building wealth involves several key strategies working in concert. It's not about one magic bullet, but a sustainable system. Let's dissect the core components:

1. The Power of Consistent Saving: Fueling Your Financial Engine

Consistent saving is the foundation. Aim for a high savings rate – at least 50% of your income. This might seem daunting, but small changes add up. Cutting back on daily lattes, streamlining subscriptions, or finding more affordable alternatives can free up significant funds. Budgeting apps can track your progress and highlight areas for improvement. Isn't it surprising how much seemingly small expenses add up over time? This consistent saving is crucial for building the momentum you need.

2. Smart Investing: Making Your Money Work for You

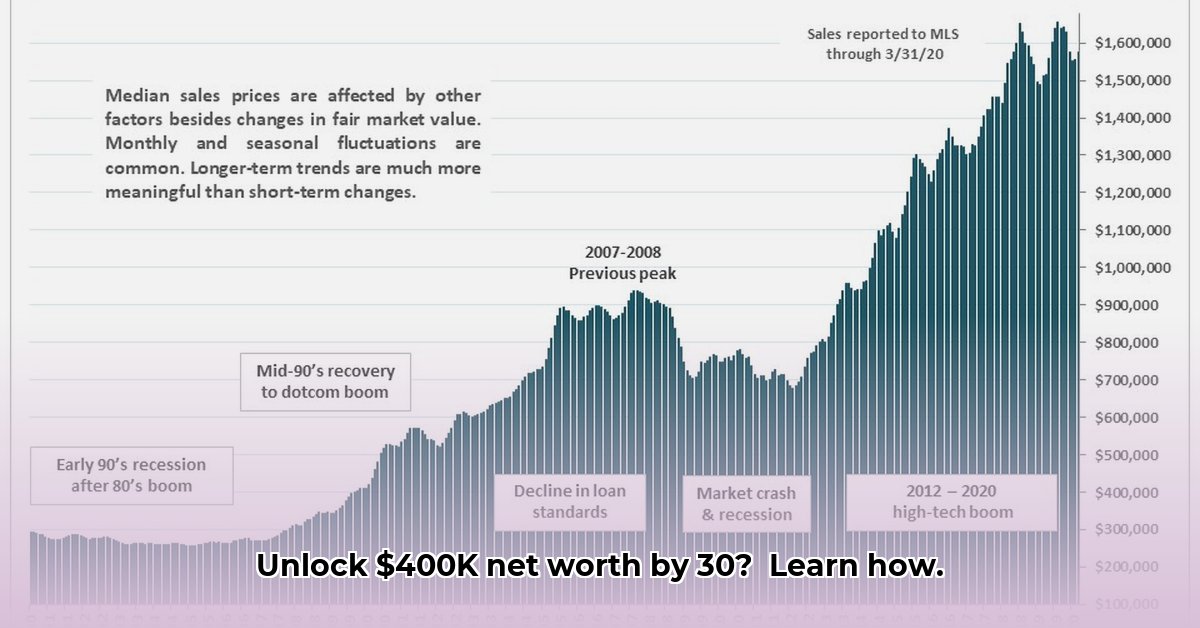

Saving alone isn't enough; you need to grow your savings. Low-cost index funds are a great starting point, offering diversification and long-term growth. As you gain experience consider real estate or bonds. Remember, all investments involve risk. Diversification is key, and only invest in what you understand. Seeking advice from a financial advisor is always a good option. What's the most effective way to diversify your portfolio for optimal growth?

3. Budgeting: Navigating Your Financial Landscape

A budget isn't restrictive; it's your financial compass. It provides clarity and control. Track your income and expenses meticulously and utilize budgeting tools. Identify areas where you can cut back. Redirect this extra money towards savings and investments. Regularly review and adjust it as your circumstances evolve. How accurate is your current understanding of your monthly spending habits?

4. Lifestyle Choices: Intentional Spending for Long-Term Gains

Building substantial wealth often requires conscious lifestyle choices. It's not about deprivation but about aligning spending with your long-term goals. Indulge occasionally, but prioritize needs over wants. Consider experiences over material possessions for a more fulfilling life. How can you balance your current lifestyle with your larger financial ambitions?

Your Actionable Plan: A Roadmap to $400k

This structured approach will guide you toward your financial goals:

- Gain Financial Clarity: Track your spending for a month to establish your financial baseline.

- Create a Budget: Design a budget incorporating your income, expenses, savings, and investment plans. Use helpful budgeting apps to streamline this process.

- Maximize Savings: Identify opportunities to increase income (side hustles, salary negotiations) and minimize expenses. Even small adjustments accumulate over time.

- Develop an Investment Strategy: Research diverse investment options and align them with your risk tolerance and objectives. Begin small and gradually increase investment amounts.

- Regular Review and Adaptation: Regularly reassess your portfolio and adjust your asset allocation based on market changes and your financial progress. How frequently should you review your investment portfolio to ensure it remains aligned with your goals?

Addressing Obstacles: Navigating Life's Unexpected Turns

Life throws curveballs. Unexpected expenses or debt can derail progress. Building an emergency fund (3-6 months of living expenses) provides a safety net. Prioritize paying down high-interest debt strategically.

Real-World Inspiration: Learning from Others' Journeys

While specific details are limited, the Reddit post exemplifies the power of consistent planning and effort. It underscores that achieving significant wealth is attainable with dedication. It’s a reminder that the journey is individual but achievable. This reinforces the importance of consistent effort and long-term planning in building wealth.

Your Path to Financial Freedom Awaits

Building substantial wealth takes time and dedication. But the rewards are immense – greater financial security, reduced stress, and the freedom to pursue your passions. Start with one step, then another; your financial future is within reach.